Trusted by Australia and New Zealand’s Compliant Workplaces

The Solv difference

When it comes to injury and claims management, complexity only adds stress. Solv exists to remove that weight. Our platform makes injury and claims management effortless. No more juggling between complex systems or trying to keep up with the latest regulations. We’ve built an intuitive, cloud-based solution that streamlines your processes so you can make informed, timely decisions.

Unlock your productivity potential with our clever system that will save you time and money by effectively managing your injury and claims including self-insurance.

We cut out the unnecessary complexity. With Solv, reporting, managing claims, and keeping track of injuries is simple and straightforward.

You’re not on your own. Our experts are available to guide you through every step—from onboarding to ongoing support. If you need help, we’re here, so you can focus on what you do best.

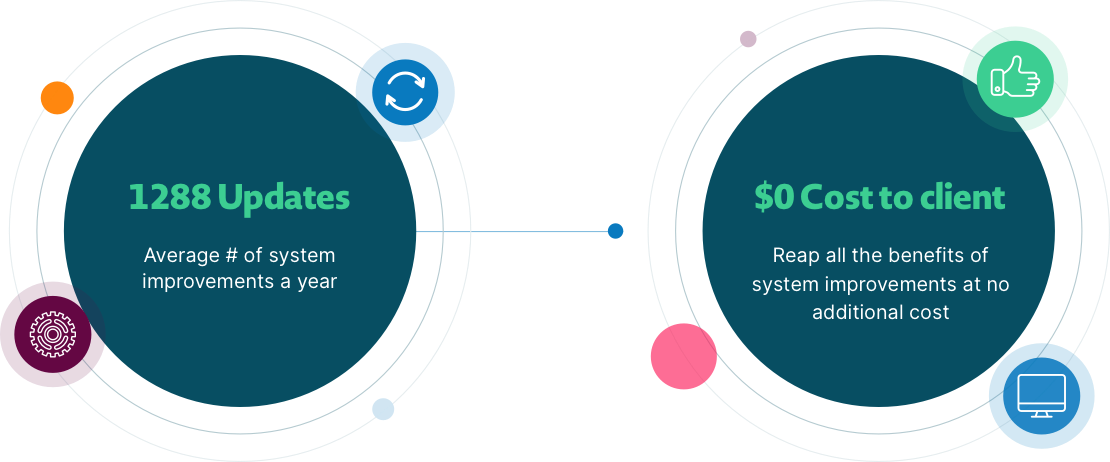

Innovation is at the forefront of our business model. Our in house developers are always looking to improve the user experience at no additional cost.

Solv easily fits into your current systems, so you can get started quickly without the hassle of complicated setup or disruptions. We also integrate smoothly with third-party apps, streamlining your processes and cutting down on duplication, often using SFTP.

Hear directly from our satisfied clients

The following is direct feedback from our annual user survey.

Frequently asked questions

What is Solv?

Solv is an online injury and claims management system that helps businesses efficiently and effectively capture, track and manage all their injury and claims information including self-insurance.

Is the platform built for enterprise?

Solv has extensive experience onboarding large clients with unique requirements and processes across a range of industries including ANZ Bank, Qantas, JB HI FI, McDonalds, BP, Coco-Cola, Toll, Broadspectrum and many more.

How long does it take to implement the system?

Successful implementation requires collaboration and regular communication from all Stakeholders. We have a tried and tested process that can take as quick as 6 weeks or as long as 18 weeks depending on the complexity of the business requirements. A timeframe will be agreed upon during the sign-up stage.

Is the system cloud based or on premise?

The Solv platform is a cloud based online system accessible on a web browser using secure login details.

Can I trial the system for free?

We offer free trial access using our live demo account. Contact us to get your free trial access and a guided demo.

What system training is offered?

We offer personalised training when you go live with the system. Once live with the system, users can easily register for regular group webinar training sessions covering different topics for various skill levels.

Still have questions?

Why not get in touch and let us answer them directly.