Trusted by Australia and New Zealand’s Compliant Workplaces

Self-Insurance Management

without the headaches

Incident + Injury to employee

Manually add Injury into Solv Platform

Capture the Incident in your Safety System

Nominated user is notified

Manage as a Claim in Solv

Manage the Injury in Solv

Ongoing Claim Management (insured + self-insured)

Claim Closed

Ditch the admin

and embrace simplicity

Simplify compliance with a system that takes care of the details—built-in legislation for every state, self-insurance, and Comcare, all in one easy-to-use platform. No more headaches, just results.

Simplified Workflows & Processes

Say goodbye to paperwork and tedious tasks. Our smart solution streamlines everything with automated workflows, reminders, and pre-filled forms, giving you back time and energy.

Total Visibility

Keep everything in one place. Easily track and manage injuries, claims, and self-insurance details from every state, all in a single, unified view.

Built For Tomorrow

We stay ahead of the curve. By working closely with regulators, our platform automatically adapts to legislative changes, so you’re always compliant—today and tomorrow.

Self-Insurance Management shouldn’t be a juggling act. Solv makes it simple.

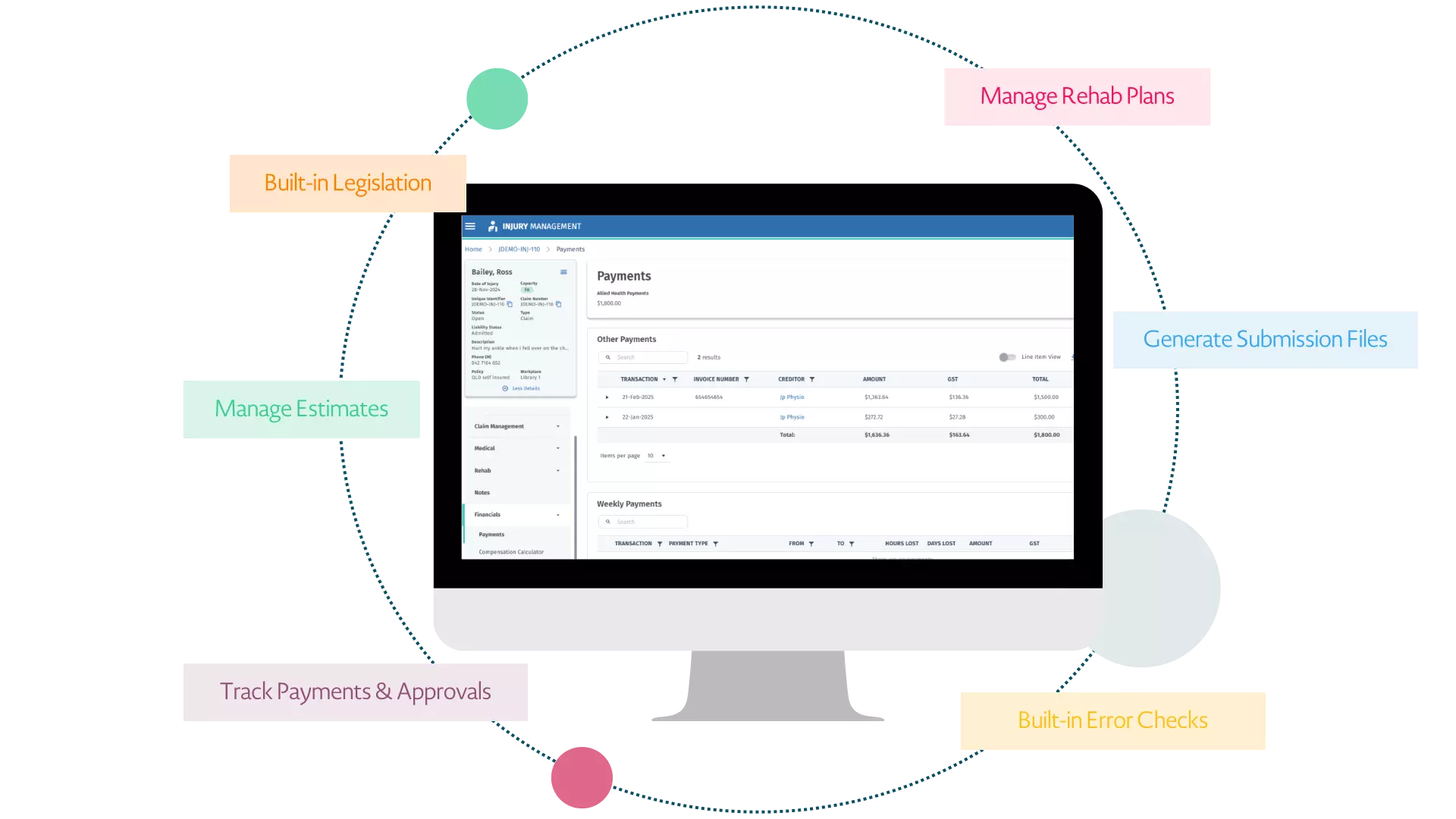

Create submission files fast

No more scrambling. Generate your submission files directly from the system, and let our built-in error checker flag potential issues before they reach the regulator.

Keep payments in check

Track your payments, estimates, and approvals effortlessly. Need to pass it to Accounts Payable? We’ve got export files ready in no time.

Rehabilitation Programs

Simplify the management of rehab plans. Easily record approved sessions, track attendance, and generate all necessary rehab documents in one place.

Don’t let Self-Insurance Management weigh you down.

Solv lightens the load.

Come across to the

Solv side

We’re here to make sure you get the best platform with a simple setup process. Solv fits businesses of all kinds and we’ve got a track record of helping self-insured companies move from other systems without the hassle. Plus, we’ve got your back with ongoing training, a full resource hub, and unlimited support.

Market Leading Platform

of Self-Insurance Licences

of Comcare Licences

of the ASX 100

Powerful Reporting Solution

Turn your self insurance data into smart decisions.

Get the insights you need, fast. Our built-in reporting tools make it simple to track your claims and compare key metrics. Customisable reports, easy exports, and quick load times give you full control.

Plus, access standard reports, charts, and dashboards that help you stay on top of what matters most. All designed to help you make smarter decisions, without the hassle.

Frequently asked questions

What is Solv?

Solv is an online injury and claims management system that helps businesses efficiently and effectively capture, track and manage all their injury and claims information including self-insurance.

What happens when the regulator introduces new legislation?

We stay on top of legislative changes across Australia by working directly with regulators, so our developers can update the platform for you—at no extra cost.

What Support is offered?

Our knowledge base lets you learn at your own pace with easy access to “how-to” videos, guides, and feature updates. Plus, we offer regular webinar training sessions and ongoing support via an in-built widget whenever you need it.

Is the platform built for enterprise?

Solv has worked with major organisations like ANZ Bank, Qantas, JB Hi-Fi, McDonald’s, BP, Coca-Cola, Toll, and Broadspectrum, helping them tackle their unique challenges. Our experience with large enterprises means we know how to deliver tailored solutions that truly fit their needs.

Is the system cloud based or on premise?

Access Solv anytime, anywhere with our secure, cloud-based platform—just log in through your web browser and you’re all set.

What system training is offered?

We provide personalised training when you go live with the system, and after that, users can easily sign up for regular group webinars tailored to different topics and skill levels.

Still have questions?

Why not get in touch and let us answer them directly.

Self Insurance Management

Managing self-insurance doesn’t have to be a headache. While many businesses opt for comprehensive insurance, others choose self-insurance to save on premiums. That’s totally understandable—running a business can get expensive. But with ever-evolving compliance regulations, rehab plans, and return-to-work strategies, it can be a real challenge to keep track of it all.

The good news? There’s an easier way. Solv’s intuitive platform streamlines self-insurance management so you can stay on top of claims, workers’ compensation, and compliance—without the hassle. Whether you’re a growing business or a large enterprise, Solv has you covered.

What are the different types of self insurance available?

Self-insurance is when a company takes on the responsibility of handling its own compensation claims. This can include anything from general liability to worker’s compensation. While the freedom of managing your own risks can be appealing, there’s little support available to help businesses juggle claims and workplace injuries. That’s where Solv comes in. We’re here to provide a comprehensive, market-leading platform designed specifically for self-insurance management.

Trusted by Australia and New Zealand’s leading workplaces

We work hand-in-hand with regulators across all states to ensure legislative changes are automatically updated within the platform. Plus, with cloud-based access, you can manage your self-insurance from anywhere. And don’t worry about security—Solv is hosted on Microsoft Azure and is ISO 27001 accredited. Your data is backed up daily, so you’re always covered.

With Solv, you get a complete, organised record of all employee injuries and claims. You can set custom visibility levels, ensuring only the right people have access to specific data based on their role or location.

How much does the average self insurance cost in Australia?

The cost of self-insurance depends on your business’s unique needs and operations. Implementing solid Work Health and Safety (WHS) practices can help reduce injuries and claims, leading to a lower overall cost.

When compared to traditional workers’ compensation premiums, which average 1.48% of wages (as of 2022), it’s easy to see why businesses are opting for self-insurance. With Solv, you not only save on premiums but also reduce the time spent on administrative tasks. Our platform makes managing claims and compliance easier with pre-populated forms and automated workflows.

All the self insurance functionality you need is built in Solv.

Switching to a paperless, online solution will free up your time, allowing you to focus on proactive employee management. With Solv, you can apply Return-to-Work (RTW) guidelines and keep your team informed—even if they’re not physically present.

What is the difference between self insurance and fully insured?

Self-insurance and fully insured policies differ in several ways:

Application Process: Self-insurance requires a business permit to manage losses and claims internally, while full insurance typically renews based on contract terms.

Recurring Fees: With self-insurance, you only pay when claims arise. Full insurance, however, often comes with recurring premiums.

Coverage Scope: Self-insurance means covering the costs with your own resources, whereas full insurance takes on most or all of the costs.

Whether you’re looking to set up a new claims system or enhance your existing framework, Solv is here to help. We’ll guide you through our platform’s features, including our powerful reporting tools that turn data into actionable insights.